L-EOS

Next-generation economic scenario generator for institutional excellence

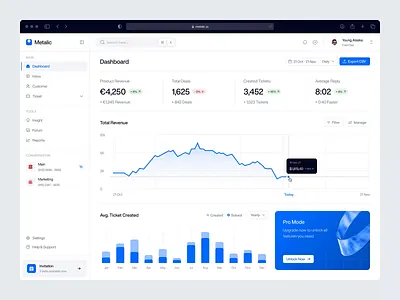

Advanced risk modeling platform that empowers institutional clients with sophisticated capabilities, seamless integration, and real-time scalability for superior decision-making in complex financial environments.